- Finset.ai Research

- Posts

- Shift4 Payments: Put Option Sale for 27% Annualized Return

Shift4 Payments: Put Option Sale for 27% Annualized Return

Over 40% ARR expectations from this relatively unknown payment processor

📈 Option Sale Trade

Sell June 21'24 PUT Contract at a $60 strike price for a $1.50 premium.

Collateral Required: $6,000

Premium Earned: $150

Return on Collateral: 2.5% in 38 days or ~27% Annualized.

Probability of Profit: 79%

Worst Case Scenario: Stock price falls to or below $60 in 38 days at which point we will be forced to buy 100 shares for $6000.

🗒️ Quick Summary

Ticker: FOUR

Continuing with a theme of buying payment processors here is another one to consider. Shift4 Payments. Shift4 is a leading provider of integrated payment processing and technology solutions. The company offers a comprehensive suite of payment processing services, including a secure payment gateway, EMV solutions, point-to-point encryption, tokenization, and a variety of payment devices. Shift4 serves a wide range of industries, including hospitality, retail, e-commerce, and healthcare, providing innovative and secure payment processing solutions to businesses of all sizes.

Stock is quite volatile so selling put options to enter is not a bad trade. We don't have the position in the stock but it is worth further exploration.

Current Price (at the time of writing): USD 65.73

🎯 What do we expect?

Total Return if the stock continues with expected Earnings Growth of roughly 41% Total Annual Rate of Return if we hold until the end of 2026.

Shift4 Payments Total Annual ROR

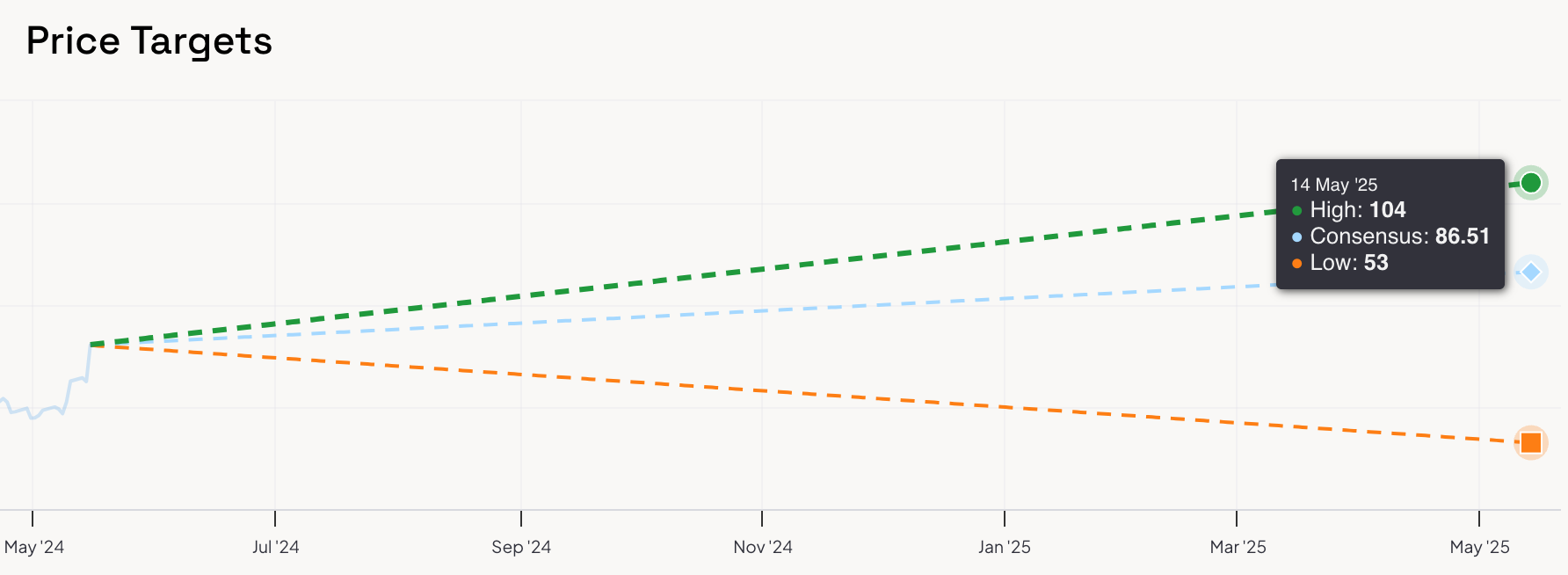

🎯 What analysts think (Price in One Year):

Avg. Price: $86.51 (+32% Gain)

Highest Price: $104(+58% Gain)

Lowest Price: $53 (-18% Loss)

🎯 What do financial models think:

Avg. Price: $94.71 (+38%)

Financial Model Breakdown:

5Y DCF EBITDA Exit: $119.61 (81.88%)

5Y DCF Growth Exit: $113.77 (73.01%)

5Y DCF Revenue Exit: $115.20 (75.24%)

PB Multiples: $76.38 (16.14%)

EBITDA Multiples: $94.23 (43.34%)

Revenue Multiples: $88.67 (34.87%)

P/E Multiples: $76.32 (16.06%)

PS Multiples: $93.31 (41.94%)

EBIT Multiples: $74.89 (13.90%)

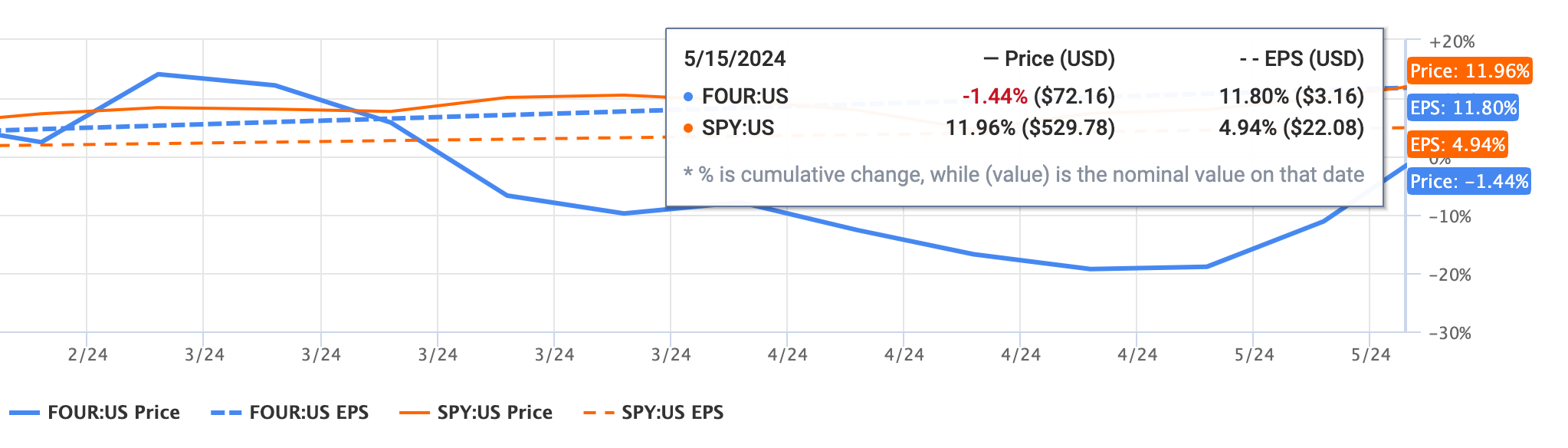

🕰️ Historical Performance vs. S&P500

The stock has underperformed S&P over the last 3 years despite having better earnings growth.

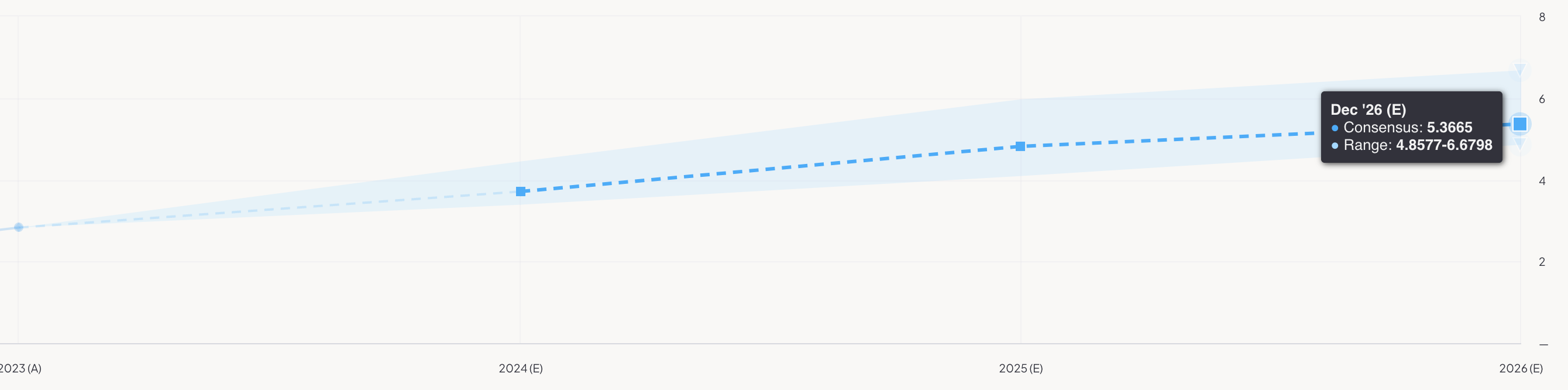

🔮 Future Earnings Expectations

Future earnings expectations are impressive. Almost 30% EPS growth in 2024 and 2025 and then slowing down to 11% in 2026.

🐂 Key Bullish Arguments

Revenue Growth Despite missing top-line estimates, Shift4 reported Q1 2024 revenue of $707.4M, showcasing strong underlying business performance. End-to-End (E2E) Payment Volume increased by 50% year-over-year.

Profitability Shift4 is a profitable business unlike many high-growth fintech peers, with adjusted EBITDA growing 36% year-over-year to $121.7M in Q1 2024. For 2024, adjusted EBITDA is projected to grow faster than revenues.

Positive Market Reaction The stock price increased by more than 14% following the earnings report, indicating positive market sentiment despite the earnings miss.

Upgraded Financial Outlook Management upgraded the full-year outlook for E2E Payment Volume, adjusted EBITDA, and adjusted Free Cash Flow (FCF). Projected E2E Payment Volume for 2024 is $167-175B (+53% to +61% year-over-year). Adjusted EBITDA is expected to rise to approximately $400M in 2024.

Strategic Acquisitions Recent acquisitions like Appetize and Finaro are expected to boost end-to-end volumes and adjusted EBITDA. The acquisition of Revel Systems for $250M will further expand Shift4’s market presence.

🐻 Key Bearish Arguments

Earnings Miss Q1 2024 earnings report showed a significant miss on both top and bottom-line estimates, which might raise concerns about growth sustainability.

Market Pressure The stock has been under intense selling pressure after concluding its strategic review without a deal, despite rejecting multiple buyout offers.

Analyst Skepticism There is a noted disconnect between the company’s seasonality trends and analyst expectations, which could lead to further misalignment and volatility.

High Growth Expectations The ambitious projections for revenue and EBITDA growth might be difficult to achieve, especially in an uncertain macroeconomic environment.

Dependency on Acquisitions Shift4’s growth strategy heavily relies on acquisitions, which can be risky and might not always deliver the expected synergies and returns.

🆚 How does it compare to other companies?

Other payment processors worth further exploring:

Euronet Worldwide

EFT, or Euronet Worldwide, is a company that provides electronic payment and transaction processing solutions for financial institutions, retailers, service providers, and individual consumers. The company offers a wide range of services, including ATM network participation, outsourced ATM and POS management solutions, electronic distribution of prepaid mobile airtime and other electronic payment products, and money transfer services. Euronet Worldwide operates in three primary segments: Electronic Financial Transaction (EFT) Processing, epay, and Money Transfer. The EFT Processing segment provides electronic payment solutions, including ATM and POS services. The epay segment distributes prepaid mobile airtime and other electronic payment products. The Money Transfer segment offers consumer-to-consumer money transfer services.

Positives

15% average projected earnings growth per year

Trades below P/E ratio adjusted for future earnings growth

Financial models project a 25% upside

Low volatility

Negatives

Analyst revisions downward.

Arguments that growth is already priced i

Nuvei Corporation

uvei is a global payment technology company that provides a platform which enables businesses to accept payments and optimize their payment processing. Nuvei offers a diverse range of payment solutions, including e-commerce, mobile, point-of-sale, and unattended payments. The company serves a wide array of industries, including retail, hospitality, gaming, and financial services, by providing innovative payment technology and seamless transaction experiences for its customers.

Positives

Financial models upside

Generally bullish sentiment

Negatives

High Volatility

Not profitable company

Potential Private equity takeover on the horizon

Conclusion

Shift4 Payments is another great choice for a payment processor. A few concerns that the stock hasn't been moving even when positive news struck until recently. The company has an ambitious founding team that is frustrated with the way the market perceives the company despite continuous growth and an impressive customer list, the market doesn't seem to recognize the company. We believe the company is positioned well to continue growing and offers a decent margin of safety at its current price. The stock has enough volatility to make selling puts a good strategy if you don't want to own the stock outright.

Disclaimer

I currently do not have an active position in any of the companies mentioned above but am thinking of initializing in the next few days. As usual, the information provided in this newsletter is for general informational purposes only. All information in the newsletter is provided in good faith, however, we make no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, availability, or completeness of any information. The content of this newsletter does not constitute financial advice, investment advice, or any other type of advice and should not be relied upon for any individual circumstances. We are not financial advisors, and you should consult with a professional before making any investment decisions. Any action you take upon the information in this newsletter is strictly at your own risk, and we will not be liable for any losses and/or damages in connection with the use of our newsletter.

Happy Investing,

Andy