- Finset.ai Research

- Posts

- Sell Puts on this Brazilian payment processor

Sell Puts on this Brazilian payment processor

Estimated 27% annualized return from put sale trade on StoneCo Ltd. a Brazilian payment processing company.

🗒️ Quick Summary

StoneCo Ltd is a Brazilian financial technology company that provides financial services and solutions to empower small and medium-sized businesses in Brazil. The company offers a range of services, including payment processing, financial software, and technology solutions to help businesses manage their operations more efficiently. StoneCo aims to simplify and democratize financial services for businesses, enabling them to thrive in the digital economy.

Analysts, Bloggers, P/E Forecast and Financial models are quite bullish on the stock. The stock also has enough volatility to make Selling Puts a profitable strategy.

Current Price (at the time of writing): USD 16.28

📈 Potential Trade

Sell May 27'24 Put at $15 strike price for a $0.30 premium.

Collateral Required: $1500

Premium Earned: $30

Return on Collateral: 2% in 27 days or ~27% Annualized.

Probability of Profit: 81%

Worst Case Scenario: Stock price falls to or below $15 in 27 days at which point we will be forced to buy 100 shares for $1500.

🎯 What do we expect?

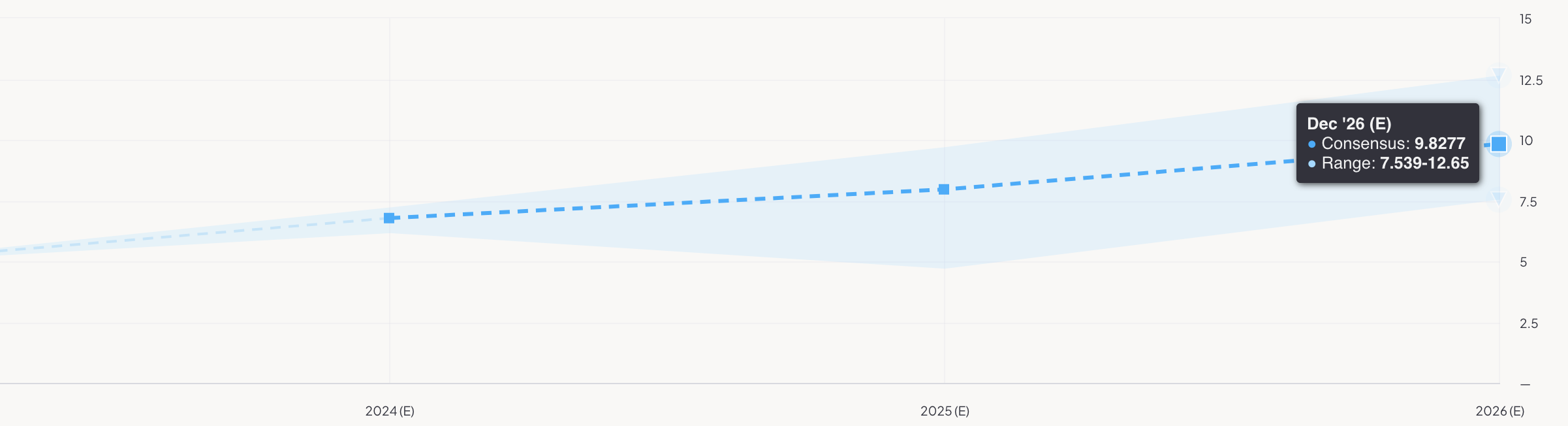

Total Return if the stock continues with expected Earnings Growth of roughly 50.27% Total Annual Rate of Return if we hold until 2026.

Expected Rate of Return on STNE

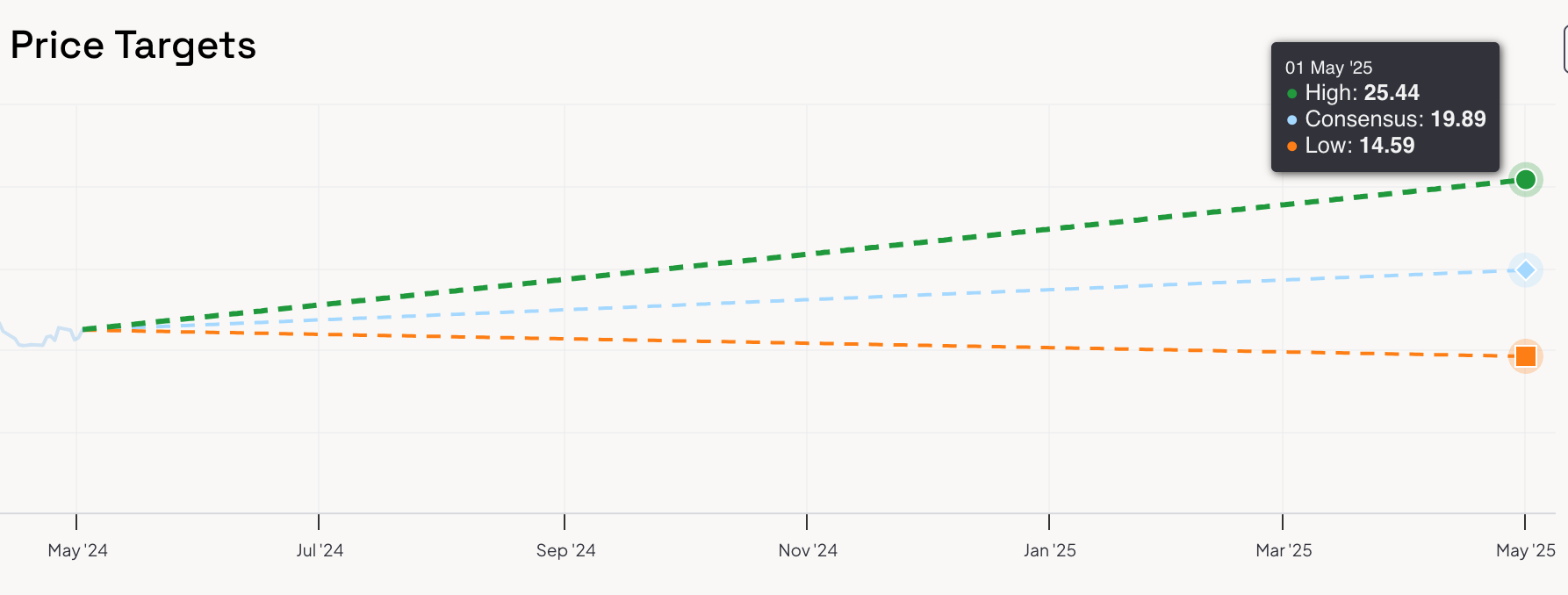

🎯 What analysts think (Price in One Year):

Avg. Price: $19.89 (+22% Gain)

Highest Price: $25.44 (+50% Gain)

Lowest Price: $14.59 (-10% Loss)

🎯 What do financial models think:

Avg. Price: $22.48 (+38%)

Financial Model Breakdown:

Earnings Power Value: $22.70 (39.43%)

P/E Multiples: $21.37 (31.27%)

PS Multiples: $21.01 (29.01%)

PB Multiples: $22.20 (36.32%)

Revenue Multiples: $23.75 (45.84%)

EBIT Multiples: $22.97 (41.11%)

EBITDA Multiples: $23.37 (43.53%)

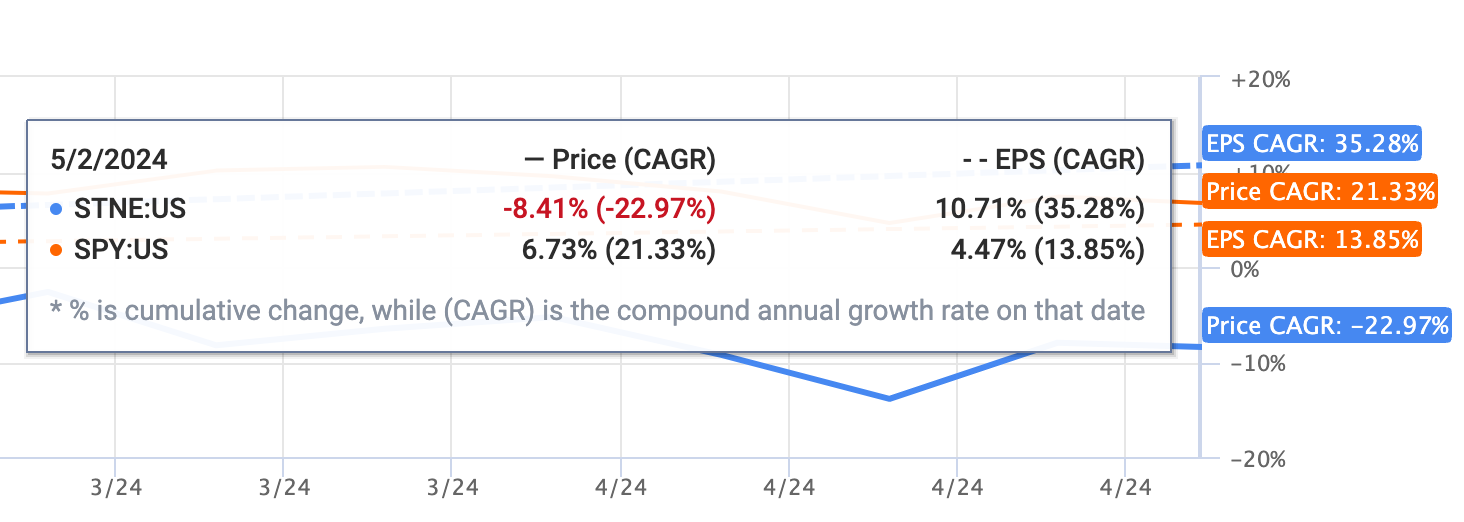

🕰️ Historical Performance vs. S&P500

StoneCo significantly underperformed SPY over the last 3 years but outperformed over the last year. Here is what happened. Back in 2020, the stock was absurdly overvalued, trading at a whopping 162 P/E ratio and a price of $92 with a fair valuation of around $15. Over the next 2 years, the EPS dropped by 80% and the stock price followed dropping 86% to a reasonable P/E of 17.

🔮 Future Earnings Expectations

Average expected earnings growth for 2024 is around 50%, 17% in 2025 and 23% in 2026.

🐂 Key Bullish Arguments

Resilience in Tough Markets:

Despite a sharp initial drop after its Q4 earnings, StoneCo's stock recovered significantly, indicating strong market resilience and investor confidence.

The article suggests the company is still undervalued, with strong recovery prospects backed by its performance in the Latin American market.

Strong Financial Performance:

Q4 FY2023 showed a 20% YoY increase in consolidated revenues and a significant improvement in adjusted EBT, reflecting robust financial health.

StoneCo’s payments business for MSMBs witnessed a 37% YoY increase in the active client base, and TPV increased by 20% YoY.

Market Share Expansion:

The company's strategy led to a market share expansion, particularly in financial services for MSMBs, boosting both client base and transaction volumes.

Pricing Power and Cost Management:

StoneCo demonstrated pricing power by increasing its take rate while managing to reduce financial expenses, contributing to better margins.

Strategic Positioning in Latin America:

Given the growing fintech market in Latin America, StoneCo's strategic focus on this region is expected to drive further growth and expansion.

🐻 Key Bearish Arguments

Identification as a Bank Rather than a Fintech:

StoneCo is perceived more as a bank, leading to concerns over increased regulatory and credit risks, which could impact its valuation and growth trajectory.

Management of Loan Loss Provisions:

Concerns over the management of loan loss provisions and potential impacts on profitability have been highlighted as the company's growth becomes tied to balance sheet risk.

Slowing Customer Growth:

Despite strong growth numbers, there is a noticeable slowdown in new customer acquisition, which could signal a deceleration in growth momentum.

Software Sales Weakness:

The software segment saw a decline in revenues and profitability, indicating challenges in this area of the business.

Tax Increases:

Expected increases in effective tax rates could negatively impact net earnings and overall profitability.

Loan Loss Provisioning Risk is a serious one so let's dig deeper into it. With Loan Loss Provisioning expected to jump to R$40MM that is still fairly small as a % of total loans which are roughly R$4.5B. That is roughly 0.5%. Here is how it compares to major banks during stable financial periods:

"Major banks in stable economic periods might have a loan loss provision to total loans ratio between 0.5% to 1.5%. This range can vary depending on the specific credit environment and loan portfolio characteristics." It is a major risk so we implore you to research this further.

🆚 How does it compare to other companies?

Other payment processors worth further exploring:

Shift4 Payments

Shift4 Payments is a payment processing company that provides a range of integrated payment processing and technology solutions. They offer a variety of services including payment processing, point-of-sale (POS) systems, secure payment gateway, and merchant services. Shift4 Payments aims to provide secure, efficient, and innovative payment solutions for businesses of all sizes.

Positives

Solid expected earnings growth, trades below historical P/E adjusted for earnings growth.

Financial Models project around a 50% upside.

Negatives

Analyst revisions downward.

Poor historical performance.

High Volatility

Euronet Worldwide

EFT, or Euronet Worldwide, is a company that provides electronic payment and transaction processing solutions for financial institutions, retailers, service providers, and individual consumers. The company offers a wide range of services, including ATM network participation, outsourced ATM and POS management solutions, electronic distribution of prepaid mobile airtime and other electronic payment products, and money transfer services. Euronet Worldwide operates in three primary segments: Electronic Financial Transaction (EFT) Processing, epay, and Money Transfer. The EFT Processing segment provides electronic payment solutions, including ATM and POS services. The epay segment distributes prepaid mobile airtime and other electronic payment products. The Money Transfer segment offers consumer-to-consumer money transfer services.

Positives

15% average projected earnings growth per year

Trades below P/E ratio adjusted for future earnings growth

Financial models project a 25% upside

Low volatility

Negatives

Analyst revisions downward.

Arguments that growth is already priced in

Nuvei Corporation

uvei is a global payment technology company that provides a platform which enables businesses to accept payments and optimize their payment processing. Nuvei offers a diverse range of payment solutions, including e-commerce, mobile, point-of-sale, and unattended payments. The company serves a wide array of industries, including retail, hospitality, gaming, and financial services, by providing innovative payment technology and seamless transaction experiences for its customers.

Positives

Financial models upside

Generally bullish sentiment

Negatives

High Volatility

Not profitable company

Potential Private equity takeover on the horizon

Conclusion

StoneCo Ltd. stands out as a Brazilian fintech. The company's strategic focus on simplifying financial services aligns with bullish market sentiments, underscored by analysts' projections of significant stock price gains and a robust forecasted annual rate of return of roughly 50.27% by 2026. Especially since the stock priced climbed down from its absurd highs.

Keep the risks in mind. Potential challenges such as the company's shift towards a more traditional banking model may introduce increased regulatory and credit risks. Additionally, concerns around loan loss provisions and slowing customer growth highlight areas of caution. Despite these risks, StoneCo's current loan loss provisioning remains within typical ranges for major banks in stable conditions, suggesting that its risk management is effectively calibrated to its operational context.

Disclaimer

I currently do not have an active position in any of the companies mentioned above but am thinking of initializing in the next few days. As usual, the information provided in this newsletter is for general informational purposes only. All information in the newsletter is provided in good faith, however, we make no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, availability, or completeness of any information. The content of this newsletter does not constitute financial advice, investment advice, or any other type of advice and should not be relied upon for any individual circumstances. We are not financial advisors, and you should consult with a professional before making any investment decisions. Any action you take upon the information in this newsletter is strictly at your own risk, and we will not be liable for any losses and/or damages in connection with the use of our newsletter.

Happy Investing,

Andy